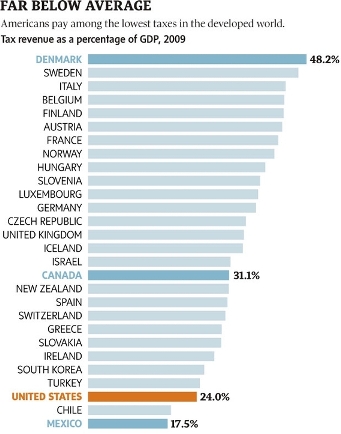

Here James Fallows shows a chart (reproduced at right) that indicates how taxes as a % of GDP are very low in the U.S. as compared to other developed nations. Then he suggests that in order to solve the deficit problem we need to raise taxes. This is a total non-sequitur. The higher the GDP a country achieves, the lower the tax/GDP ratio should be. Suppose you live a hypothetical country where GDP is $100 per person, and taxes are $30 per person, and things are generally ok – the military is big enough, there are enough roads, etc. Then you as a country develop very quickly, so that GDP doubles to $200 per person, would you also want to double the tax money sent to the government to $60 per person? Only if you are obsessively fond of the government. The government is there to keep us safe and secure, and to provide infrastructure. These needs clearly should not scale linearly with how rich we are. When we become a lot richer, we should strive to become a lot more entertained, not a lot safer and securer, unless we are, to begin with, very unsecure and unsafe.

Here James Fallows shows a chart (reproduced at right) that indicates how taxes as a % of GDP are very low in the U.S. as compared to other developed nations. Then he suggests that in order to solve the deficit problem we need to raise taxes. This is a total non-sequitur. The higher the GDP a country achieves, the lower the tax/GDP ratio should be. Suppose you live a hypothetical country where GDP is $100 per person, and taxes are $30 per person, and things are generally ok – the military is big enough, there are enough roads, etc. Then you as a country develop very quickly, so that GDP doubles to $200 per person, would you also want to double the tax money sent to the government to $60 per person? Only if you are obsessively fond of the government. The government is there to keep us safe and secure, and to provide infrastructure. These needs clearly should not scale linearly with how rich we are. When we become a lot richer, we should strive to become a lot more entertained, not a lot safer and securer, unless we are, to begin with, very unsecure and unsafe.

(chart from OECD)

“The government is there to keep us safe and secure, and to provide infrastructure.”

That’s debatable; some people think the government should also redistribute wealth. You can refute that position but I don’t think you should omit it.

Also, some people are richer than others, and so are safe and secure when the government has N funding. However, some people are poorer than others and are not safe and secure at N funding, and would require 1.5N funding to be safe and secure. Your hypo assumes that everyone’s needs are met simultaneously at your current level of funding.

“When we become a lot richer, we should strive to become a lot more entertained, not a lot safer and securer, unless we are, to begin with, very unsecure and unsafe.”

I think this is a false choice fallacy. We could become more entertained as well as more secure or safe. I understand that there can be diminishing returns on anything, but whether the diminishing returns have kicked in for government funding is a more complicated question than you’re making it out to be. On military spending? I think so. Pell grants? I doubt it.

“Suppose you live a hypothetical country where GDP is $100 per person, and taxes are $30 per person, and things are generally ok – the military is big enough, there are enough roads, etc. Then you as a country develop very quickly, so that GDP doubles to $200 per person, would you also want to double the tax money sent to the government to $60 per person?”

I know you are simplifying to make a point, but I just wanted to propose the possibility that doubling GDP might entail an increase in demand on government resources (you’d need more IRS auditors, additional regulators to oversee this explosion in industry, more environmental study to anticipate impact of so much new infrastructure), if not necessarily by the same factor which multiplied GDP.

-On wealth redistribution, I agree there should be some (that is covered in my assertion that the govt. should keep us “secure”), but it should not scale linearly with a country’s wealth (the purpose of it should be to provide for the poor, and while increased wealth might lead to increased money for the poor, I would say it should not scale, again, unless the poor were very bad off to begin with).

-On my example, I agree that there will be “an increase in demand on government resources,” and that doesn’t contradict anything I’ve said. I am just saying it doesn’t scale *linearly*. But when you present “spending as a % of GDP” and pretend that tells the story, you are suggesting that the demand should increase precisely linearly, and that any deviation from that is to be questioned.

-You suggest some things (military) should not scale less than linearly and some (Pell grants) should perhaps should scale linearly. If you have a mix of some things that scale linearly and some things that scale less than linearly, the overall will scale less than linearly, which all that I am trying to say.

I understood “secure” to me “secure from external threats,” not “secure from violent overthrow by the proletariat.” In that case, you did cover it.

I think that your claim that taxation need not scale linearly is very strong, but I think you strayed into hyperbole (and I interpreted you very literally) when you said

“When we become a lot richer, we should strive to become a lot more entertained, not a lot safer and securer, unless we are, to begin with, very unsecure and unsafe.”

That sounds like you think entertainment, unlike safety and security, should scale linearly. Also, I read the Fallows post, and I don’t see where he suggests that taxes should scale linearly. Which authors or pundits are making that claim?

What was hyperbolic about that statement? If anything it was just not precise enough – the more precise way of saying it would be to say that when we become a lot richer by a factor of X, we should become more entertained by a factor of > X, and safer and securer by a factor of < X. He doesn't make the statement explicitly, but the use of the fact that the taxes/GDP ratio in the U.S. is low to support the idea that we should have more taxes suggests that there is a natural linear relationship between taxes & GDP. If I put up a chart showing that the ratio of taxes to number of rivers in the U.S. is very high, and argued that we should reduce taxes, the implication is that there is a natural linear relationship between # of rivers and taxes.